We've gotten to the fun bucket list... the one where we talk about money. Ahhh! Let's just put it out there, not many people enjoy talking about money. Many of us cringe at the words budget and saving. Not because we think they lack value but because we know they are tools that often require sacrifice in the now. I think we all go into the year with the best of intentions but a lot of the time we don't really write out a plan of action. In a sense, this is my plan of action. It is a bit vague but these are some of the things I know need major work in order for me to be happy with where I am financially by the end of 2014.

1| Make short term savings goals

I'm going to be honest here, I am not the best at saving. Unless I have a trip or item that I am saving for, I tend to live pay check to pay check. This is definitely something I want that to change in 2014. This year I want to start actively budgeting so I can pay things off quicker and start saving for new opportunities and life's surprises.

2| Be accountable to my budget

So if my number one item hits on creating a budget, my number two is to find people in my life that will encourage me and keep me accountable to said budget. Being a single person I think that it is important to find friends you trust that will help you talk through big purchases that will effect your budget. Because, we don't have to run our spending by a spouse or a significant other sometimes it leads to unwise choices. Accountability is key to stopping buyers remorse.

3| Write down my longterm dreams and start money aside to make them a reality

We all have dreams, most of those dreams need to be financed in one way or another. I plan to write down some of the things I want to have unfold in my future and I am going to start saving for them. It's so easy to put saving for the longterm off. We saw we'll start next week or next month or next year because sometimes setting aside a certain amount isn't convenient or fun. But if we keep putting it off our dreams may never happen. When months come this year where it isn't easy to save, I want to challenge myself to maybe sacrifice a little now so those dreams I have will one day be a reality.

4| Overcome impulse spending

There are a few things in my life that I need to be more aware of how much money I am spending on them. It is really easy for me to buy a song or App on iTunes and not even think about how they add up. I thoroughly enjoy popping into Ulta or Sephora and trying new makeup. I am a sucker for pretty much everything in Target. Don't get me started on Starbucks. All of the above are places I spend money at on the regular and I don't need to be. This is partly going to go along with budget but I felt it needed it's own number because it needed to be recognized as a bad habit that I want to change.

5| Give more

I love being able to bless people. Whether it's paying for the person behind me in the Starbucks line, leaving an extra large tip for my waiter or giving more towards my church and missions. It makes me happy to be able to give and make an impact on others. This is something I want to integrate in my 2014 budget. I honestly believe in the principle of sowing and reaping, and while I know that it doesn't always have to be about money, I've seen the fruits of that portion of it in my life with just the little I've been able to do. I've never left a situation where I did something nice for someone else and felt bad about it or regretted it. I've always left feeling really excited and full of joy, definitely two attributes I want to fill my life.

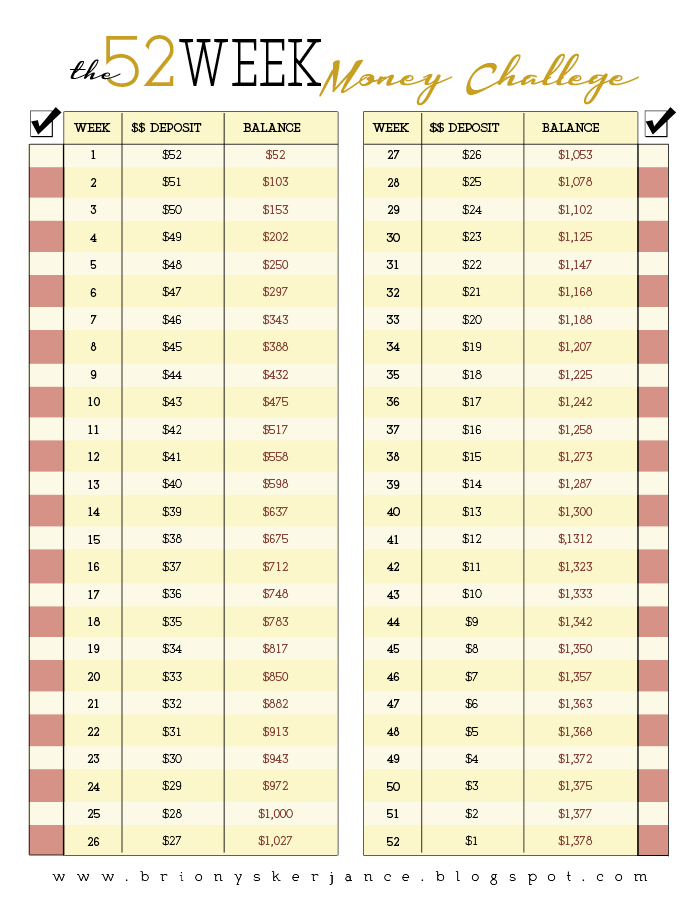

I also wanted to share this cool savings plan that has been going around the web. Recently, I've seen it being talked about on the news, Facebook and a lot of blogs. The concept is simple, there are 52 weeks in the year, each week you will set aside a dollar amount. The amount starts at $1 and ends at $52. By the end of the year you will have $1,376 saved. That's a nice chunk of change.

Most of the versions I've seen of this savings plan have you putting $1 away in week one, $2 in week two and so on. I think this is great and if it works for you, go for it! I've decided to do it a little bit different. I'm flipping the amounts, so I will be saving $52 in week one, $51 in week two and so on. I'm doing this for two reasons, I like starting the sum high because I can look forward to the amount I have to save going down each week. The second reason is because the months of November and December tend to have a lot of outflow of cash for me and it's just easier for me to set aside the higher amounts now. Whichever way you choose to save, if you are faithful, you will end up with $1,376 in the bank.

If you'd like a checklist for The 52 Week Money Challenge in reverse click here --> | Download

No matter what your financial goals are for this year, I pray

it is a year full of blessing and prosperity!

No comments:

Post a Comment